AgriPulse

AgFirst & Tracta Quarterly Update

July 2024

Introduction

Welcome to the latest edition of AgriPulse. Thank you for all the positive feedback received from our last edition, it was great to hear it hit the mark.

As we enter a new season for the primary sector, it is fair to say there are mixed emotions out there. With the government repealing a raft of compliance regulations, farmers are certainly feeling that the government is on their side. However, our processors and marketers are quietly reminding us that the market demands for meeting environmental compliance requirements have not gone away. A quote from the Fieldays said it all: “regulators bark, retailers bite.” The next twelve months will be an interesting journey as the government tries to find a more pragmatic balance to achieving environmental outcomes.

On the financial side of the equation it has not gone unnoticed that the performance in the primary sector was likely the key reason New Zealand avoided an economic recession in the last quarter. However at the farm level there is certainly a mixed bag: dairy is marginally profitable, kiwifruit has rebounded, apples are challenging, forestry returns are poor, beef is marginal and sheep farming is (generally) unprofitable. I am hearing regular anecdotes of the lack of spending from farmers as they try their best to balance the books. For those sectors facing challenging times, this is when they need the most support from those around them – friends, family, neighbours, financiers and rural professionals. Focus on ‘controlling the controllable’ and aiming to be in the top quartile of farming performance for your sector.

While there are some short term challenges, we remain optimistic for the medium and long term futures of the primary industry. The primary sector will continue to innovate and find solutions to the challenges ahead.

James Allen, AgFirst

Dairy Sector Update

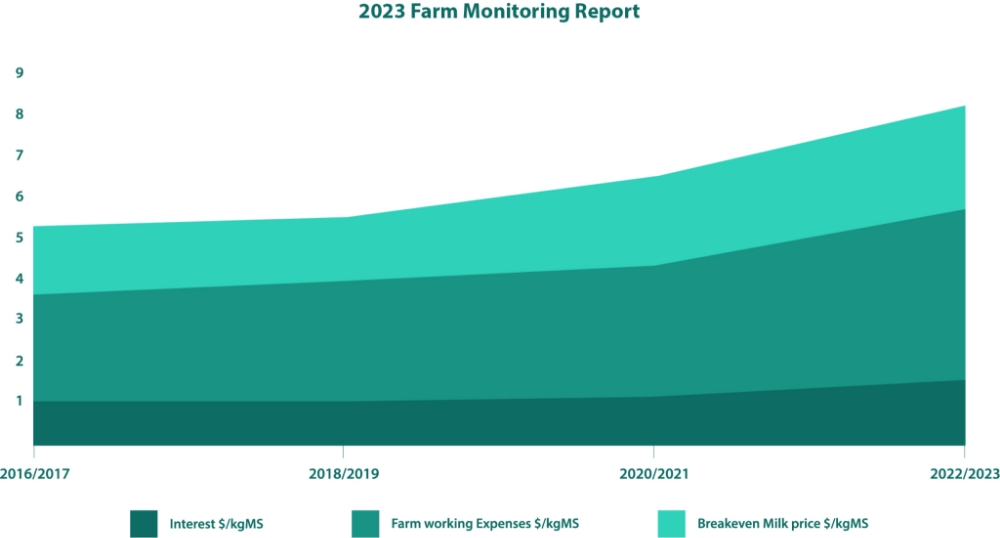

Milk price often makes the headlines, but the AgFirst Financial Survey Report highlights how important and difficult cost control is in the dairy sector as shown in the following table from the 2023 report across the Waikato/Bay of Plenty. The 2024 Financial Survey Report will be released on 24 July 2024 and will make some interesting reading – to order a digital copy of this report email waikato@agfirst.co.nz.

The breakeven milk price is required to cover the above costs plus drawings, depreciation and tax.

Farmers are conscious that while a milk price around $8.00 is good in historical terms, the rapidly increasing costs have simply eroded any margins. Expect farmers to look at all levers they have, in order to drop farm working expenses, without compromising profitable milk. The announcement of the review into rural lending has been well received by farmers, with interest in not only the trading banks, but also in the role and impact the Reserve Bank has in setting the interest rates charged to farmers.

On-farm conditions are variable. In the Waikato, we had our most trouble-free 1st June changeover, due to very good on-farm conditions, making it easy to leave contracted pasture covers and cow condition. Other parts of the country, particularly eastern regions, have more challenges on hand as the impact of the dry continues in those areas.

We noticed a drop in the number of changes with sharemilkers and contract milkers this year. Our sense is it is due to farmers realising the cost of change and looking to keep good operators on with tweaks to contracts.

Fonterra is being proactive in contacting the remaining suppliers who have still not signed up for Tiaki farm plans. These plans will be straightforward to migrate into what will be required for Fresh Water Farm Plans so farmers would be unwise to not take up the offer.

Dave Miller, AgFirst

Sheep & Beef Sector Update

The sheep and beef sector continues to have a tough time at present and overall economics in the sector remain extremely subdued. Beef returns are sitting in line with this time last year (around $6.00 – $6.20/kg) and there is some positivity about this lifting slightly for the year ahead, however the trading margin at this level remains tight as farmers have sought to shift their stocking policies toward cattle which has increased the demand and therefore purchase price. Lamb returns have lifted slightly in the last quarter and are now sitting around $6.30/kg, but this is still well below a sustainable price for lamb. The relative economics in the last two seasons have meant that two years ago, comparative sheep returns were around 25% above cattle, 12 months ago this was relatively even, but now sheep returns are around 25% below cattle and no real likely shift is forecast in the next 12-18 months. Wool is having a short-term lift in return based on recent sales with second shear wool now edging above the $2.00/kg mark, however this is still well below breakeven levels for the sector.

A key determinant of income for the coming season for sheep farmers is “lambs on the ground” and many sheep farms are now right in the middle of scanning ewes to determine the likely in-lamb numbers and therefore potential sales for the year. After another summer of good rain for much of the eastern parts of the country, and this resulting in strong ewe condition, scanning results are expected to be in line with or slightly above recent years. The drier weather conditions on the eastern parts of the country will have a negative impact on likely scanning and lambing which will further compound the problems of low market prices. Dry ewes being sold in the next month will provide little income with current pricing seeing these being worth only around $70/head.

All factors considered here, the returns from the sector remain at historically low levels. Many farmers are significantly cutting back on the few discretionary items that they have in their budget, including fertiliser and repairs and maintenance which will in effect only be artificially maintaining the bottom line. While farms that have reinvested well in their operation for the last four years are in a strong position to do this, many are not and there is the real risk that farming assets will take a backward step for a few years as farmers focus on paying the ever-increasing fixed costs. This is particularly pertinent for farms with any significant debt given the current interest rates. Don’t be fooled by talk of farms still being profitable, this is likely coming at the expense of the asset maintenance.

There is significant variation around the country at present with respect to feed levels with the eastern regions of both Islands doing it particularly hard. Many in these areas have had no choice but to reduce stock numbers which is only further compounding the dismal economic returns. It will be a tough next 12 months for the sector and there needs to be plenty of empathy for these businesses. As a country we have been here before and come out the other side so we can be positive about this, but this was only because all key stakeholders have got on board and provided support in whatever way, shape or form they could. Let’s all do what we can!

Darren McNae, AgFirst

Horticulture Sector Update

Following a harvest much improved from the 2023 challenges, exporters and marketers are now working hard in market to get the best returns for growers.

The national apple crop is down on January estimates as a result of smaller fruit size across the growing regions. However, despite the smaller size, summer conditions have been good for fruit flavour profiles, quality and storability.

The recent Environmental Protection Agency (EPA) ruling on hydrogen cyanimide being approved for continued use with updated hazard classifications and controls is good news for the kiwifruit industry, with New Zealand Kiwifruit Growers Inc (NZKGI) welcoming the decision.

For the fruit sector, winter pruning is underway. Growers are setting up their canopies for the next season, to capture the best light environments, reduce bud loads and therefore thinning bills. Climate-wise, the recent rain is recharging soil profiles ready for next season and winter chill units are tracking well to date.

Growers are looking to the future of their businesses and reconciling input costs against current returns. This includes consideration towards redevelopment, new varieties, orchard sales and acquisitions, and succession planning.

Sarah de Bruin, AgFirst

Reducing our dependence on internationally produced feed

A series of recent global events resulted in record prices for internationally produced feed (IPF) and highlighted the dependence of New Zealand’s livestock industries on imported grain and feed.

New Zealand is a net importer of grain and concentrates with imports rising to a record level of 3.7 million tonnes in 2022. The dairy industry is the largest consumer of IPF, consuming 75% of all feed imports with poultry consuming 12% and other livestock 4%. Dairy farm feed demand for supplements including IPF has increased over time due to increased cow numbers, higher stocking rates and greater milk solids production per cow.

There are opportunities to grow more grain on whenua Māori, lifestyle blocks and those sheep and beef farms which have suitable contour and soils. Smaller, less economic dairy farms, or those that are on the cusp of requiring additional labour or wishing to avoid an infrastructure upgrade (e.g. a larger farm dairy or effluent system), also represent an area for potential arable growth.

A potential way for dairy farmers to decrease their demand for IPF is to reduce stocking rates and grow more feed on-farm.

To find out more – ourlandandwater.nz

Raewyn Densley, AgFirst

Redefining excellence in agribusiness advisory

The farming world is striving to feed an ever-increasing population from a declining land area whilst at the same time reducing its environmental footprint. As farmers evolve their practices to meet these challenges, the rural advisor working alongside the farmer must also evolve to meet the needs of the industry and the wider community – or run the risk of becoming obsolete.

My recently completed Nuffield report explores the trends and issues facing the rural advisor and provides guidance for the future roles and necessary skillsets of the advisor so they can continue to add value to the primary sector. The desired outcomes from my research were to redefine what excellence looks like in agribusiness consultancy, and as a result increasing productivity in the agricultural sector, whilst at the same time reducing the environmental footprint of the primary sector.

Developments in Agri-tech are impacting on both how farmers manage their farms, how rural advisors are interacting with their clients, and how they are managing their own businesses. These issues are not new, but until they are resolved the ability for Agri-tech to influence farming in New Zealand will be constrained.

The role of a farm advisor or rural professional varies widely throughout the world, between sectors and between organisations. For those advisors whose role is purely focused on providing only technical advice, the impact of technology may be rapid and profound, to the point that their role may not exist in the future.

Read James’ full Nuffield report: Redefining excellence in agribusiness advisory: the role of the rural advisor in the modern world

James Allen, AgFirst

Considerations for agri marketers

Two main themes emerge for agri marketers this month:

Theme 1: How can you ensure your agribrand is positioned to help farmers and food producers meet shifting market dynamics and demands?

With the bulk of Tracta’s work in the last 12 months being brand repositioning and development projects, we are seeing a shifting trend toward agribusiness placing a growing level of importance on ensuring they are positioned correctly to remain competitive through changing sector dynamics and shifting consumer demand.

We believe that every agribrand across Australasia should be looking into how they future-proof their business and brand strategy to not only adjust to impending change, but show their customers they are committed to take a leadership position in helping their customers navigate through it. Why? Farmers are asking for it, the sector needs it, and a number of farmers and agribusinesses are arguably sitting perilously in a ‘what got us here, may not get us there’ situation. Government compliance pressure may be subsiding (for now), but this is looking likely to be superseded by global consumer demand. If your business has no innovation or sustainability commitment to build into your brand strategy by now, our suggestion is to consider getting it sorted ASAP if you want to remain competitive in the near future.

Start by conducting a brand audit. Assess your current brand positioning against your competitors and identify areas that need better alignment with future market demands.

Ensure you have a sustainability strategy and then look for opportunities to integrate into your brand and marketing strategy. At the Primary Industries Summit this week, the lack of storytelling in the sector was talked about on several occasions, so make a genuine commitment in your marketing to develop meaningful and powerful stories, and then report progress to the market regularly.

And invest in strengthening your leadership position in the category. Develop campaigns that position your brand’s thought-leadership in working with farmers to navigate market changes. This can include thought leadership content, webinars and partnerships with industry influencers. When customers are under pressure, they look for brands who don’t just empathise with them, but genuinely offer useful tools and insights that help them through the hard times. Be that brand.

Theme 2: How can you still encourage farmers and food producers to buy products and services when they’re so cash constrained?

Although green shoots are starting to emerge in the dairy sector, farmers and growers remain conservative with their spending. This likely to remain unchanged until we see a decline in interest rates, which creates uncertainty amongst agri marketers and rural sales teams who need to meet targets.

In the last issue we highlighted the benefits in highly concentrated segmentation, targeting and positioning strategies for acquisition campaigns, this still remains highly relevant for any product or service marketing activity across the sector. If raising brand awareness is the focus, broadcast media is still very effective to a broad farming audience, however if the focus is customer acquisition and transaction i.e. sales, focus your marketing efforts and budget on highly specific and concentrated channels that will ensure your message reaches those most likely to convert.

We are also seeing strong results in acquisition campaigns that include smart pricing and financing strategies. If you haven’t already, we recommend investigating periodic payment plans or competitive finance rates instead of relying on discounts. This approach makes it easier for farmers to manage their cash flow while still investing in necessary products or services to increase on-farm efficiencies and productivity.

In challenging times, it’s more important than ever to ensure that you communicate an understanding of what farmers are currently facing, along with clearly demonstrating how your products or services can resolve their issues or enhance their operations. The focus should be on the genuine customer benefit, more than the product or service attribute.

Kurt Sandtmann, Tracta